The Federal Government’s push to move the retirement age to 70 will impact on the dreams and realities of many Baby Boomers (those people born between 1946 and 1964). This is particularly so for those who intended to retire early and bask in the sunshine of their hard-earned equity, whether by doing the “grey nomad” gig, moving into a lifestyle housing estate or both.

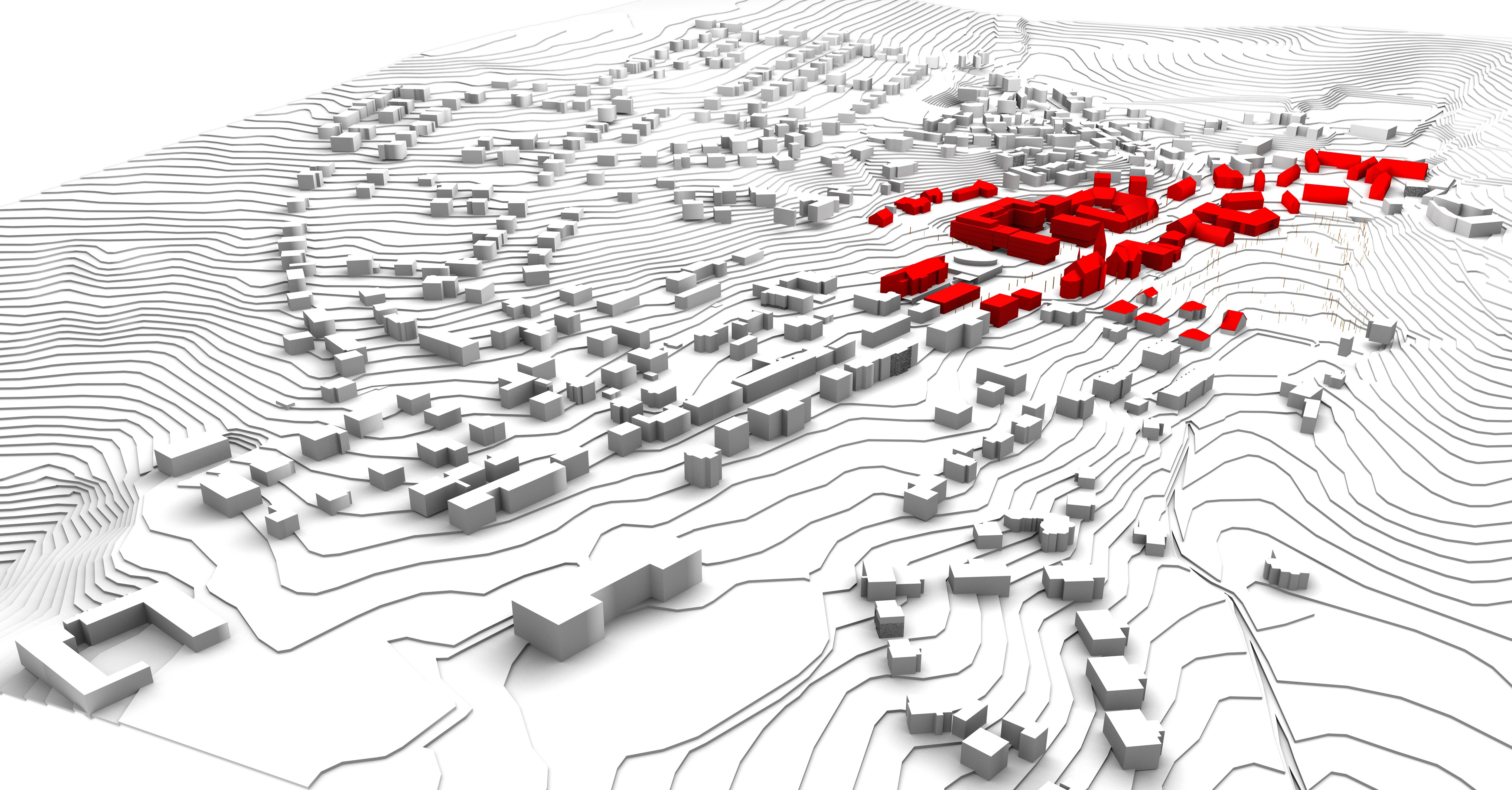

Whatever the dream, the essence of later life is to remain happy, healthy and active and to that end a new housing market is emerging in Australia. Known as Active Adult Lifestyle Communities (AALC) and based on the concept of “the good life” for life after 50, these so-called “gerotopias” are increasingly popular and prevalent in the US. Yet they do have their problems, leading to the important question: Is it OK to “ghettoise” the ageing? This is the question posed by Senior Lecturer Caryl Bosman with Griffith’s Urban Research Program.

Baby Boomers

In Australia, as is the case elsewhere in the world, Baby Boomers constitute a significant proportion of the population, with many enjoying high average annuity, moderate debt and high levels of home ownership. In fact, four out of five Australian Boomers own their own home outright. Meanwhile, a tendency among Boomers to perceive themselves as being much younger than they actually are also influences their choice of lifestyle, housing design and retirement location.They are also noted for being experienced and discerning, so-called “black-belt” consumers who spend more on leisure and recreation than both younger and older age groups. Furthermore, Boomers are often depicted as the generation that rejects retirement, thus concealing the diverse financial positions within their cohort.

Is it OK to “ghettoise” the ageing?

In Australia, the shift from a government-funded age pension to privately funded superannuation occurred in 1992 when many Boomers were between 35 and 46 years old. For older Boomers, affordable retirement housing became a real concern, although this is no longer unique given many people will retire with not much more than the equity in their homes and the government-funded age pension. However, Boomers with a sufficient self-funded income can choose the type of housing and location to suit their preferred retirement lifestyle. For some, an Active Adult Lifestyle Community (AALC) fulfils these criteria.

AALCs vs Suburbia

Many homes owned by Baby Boomers are in suburban areas which, for reasons including policy, infrastructure and finance, are not conducive to ageing. With little or no means by which to change or adapt, these are frequently perceived as places containing high risk factors. Call it the “not so good life”.

By contrast, AALCs are planned and designed specifically for the needs of Baby Boomers as they enter retirement and thus are perceived to be places with low risk factors. This is “the good life”, a commodity affordable only to those with the means and the inclination for an age-segregated lifestyle.

WOOAPies

AALCs are age-segregated, master-planned communities designed specifically for active adults between the ages of 55-74. They are usually niche market developments targeted at the cashed up, financially secure, healthy and active Baby Boomers, or WOOAPies (well off older active persons). AALCs emerged on the Australian and New Zealand housing landscape in the early 2000s and one reason for their popularity lies in offering residents the opportunity to live within a community of like-minded individuals sharing similar backgrounds, interests and aspirations.

As well as residents’ age restrictions being enforced by title deeds and covenants, children are prohibited from residing in the community for any length of time and there are no investors or renters. The result is a relatively homogenous socio-economic and demographic composition, the stuff that positive community relations are made of. So what is the problem?

Shift in mode of government

Baby Boomers have experienced the transformation of government from a welfare state to a neo-liberal regime requiring citizens to assume responsibility for, and management of, their retirement. That means keeping abreast of risks and rewards.

Governments want us to age positively, successfully and productively and the development of AALCs can be seen as a manifestation of this desire and strategy. However, while those who play the game enjoy the benefits, those who do not, or cannot, may face hardships. The increasing number of homeless older people on the Gold Coast is testimony to the latter.

Active lifestyle

The production and maintenance of “the good life” is premised on independence, active recreation, community engagement and mental stimulation. All are core ingredients of an AALC. An active lifestyle is a strategy to minimise the risks attached to ageing. Nevertheless, policies that specifically target active living often have ethical implications.

Money matters

Rather than merely buying a house, many Baby Boomers indicate their preference to purchase a specific retirement lifestyle. To maintain lifestyle preferences, enjoy “the good life” and age positively requires not just the financial wherewithal, but the knowledge and ability to use that money wisely.

AALCs offer visions of what might be called “un-retirement”, a phase of life comprising an active lifestyle and perpetual holiday experience enjoyed within the safety of the “resort”. They sell more than just “the good life”. They are selling an ideal and an idyll within a setting that is both mythical and real. Within this “heterotopia” of shared qualities and minimal risk, where everyone is just like you, one might identify the residential landscape with “ontological consumerism”.

That is to say, AALCs may afford opportunities for residents to re-create meaning and purpose in their lives through places that are understood ontologically, as habitus, as miraculous and ageless. In short, “the good life” written large and in indelible ink.

[alert style=”1″]

Dr Caryl Bosman, Urban Research Program

[/alert]

Keep up to date and subscribe to Impact @ Griffith Sciences